Have You Been Injured in an Uber or Lyft Accident in NJ?

Whether you were a passenger in a rideshare or a rideshare driver hit you, if you were injured you, may have a claim. Contact New Jersey Uber accident lawyers Jared Glugeth and David Pierguidi for a free consultation today.

The rise of rideshare services such as Uber and Lyft has made traveling more convenient. However, it has also made the road a little more dangerous. Until there is sufficient regulation, it’s unlikely that we’ll see a reduction in rideshare accidents.

This underscores the need for collaboration between rideshare companies, regulatory bodies, and law enforcement to develop effective safety measures and guidelines that protect both passengers and drivers.

Moreover, as the landscape of transportation continues to evolve, technology-driven solutions hold promise in enhancing rideshare safety. Innovations like real-time monitoring of driver behavior, improved background checks, and advanced driver-assistance systems could contribute significantly to minimizing the risks associated with rideshare services. Striking a balance between innovation and safety is crucial for the sustainable growth of this industry.

However, if you sustain an injury while using one of these services, one of our highly skilled lawyers from Glugeth & Pierguidi, P.C. can assist in your claim. Contact us today for more information!

In 2020, both Uber and Lyft released a safety report detailing the number of crash deaths reported during rides between 2017 and 2019. Although there were few fatalities for each company, there are some surprising similarities.

According to Uber’s US Safety Report, there were 107 deaths recorded in 97 crashes between 2017 and 2018. This resulted in an Uber accident fatality rate of 0.58 deaths per 100 million miles traveled in a two year period. About 21% of these deaths were Uber drivers and another 21% were passengers. Surprisingly, 58% of all fatalities were third parties not using the app. Around one-third of victims were also pedestrians, but as many as 25% of those pedestrians were Uber drivers or passengers outside the vehicle. This suggests that pick up and drop off are the most dangerous times for those using the app.

The Community Safety Report from Lyft is less detailed. According to its data, the death rate per 100 million miles traveled was 0.76 on average between 2017 and 2019. However, instead of listing the number of deaths, Lyft included only the number of crashes. Over a three-year period, Lyft reported 105 fatal crashes. Based on this information, it seems that Lyft had fewer fatal crashes than Uber in 2017 and 2018, but those crashes involved more deaths.

How Uber & Lyft Accidents Are Unique

While rideshare accidents may seem similar to other types of car accidents on the surface, they involve some unique factors. One of those factors is what stage of the ride the driver is in when the accident happens.

Another factor is the number of parties usually involved in the crash itself. Both have a tremendous impact on your claim, so it’s important to understand how they affect it.

Different Insurance Coverage Rules

Both Lyft and Uber offer different insurance coverage depending on the status of the driver. There are three stages that a driver may be in: driving with the app off, driving while waiting for a ride request, or driving to pick up/drop off passengers. Whenever a Lyft or Uber driver gets into an accident with the app disabled or off, their personal insurance policy applies. This means that the rideshare company won’t cover the accident.

However, once the driver turns their app on and is waiting for a ride request, the rideshare company’s insurance kicks in. For Lyft, this third-party liability insurance includes the following coverage in New Jersey:

- $50,000 per person for bodily injury,

- $100,000 per accident for bodily injury, and

- $25,000 per accident for property damage.

The coverage is exactly the same for Uber. However, keep in mind that this insurance applies only if the driver’s personal policy is less than the rideshare company’s policy.

If a driver accepts a ride request, the rideshare company increases the insurance coverage until the driver completes the ride. Under New Jersey Statutes § 39:5H-10, this active ride stage must include:

- $1,500,000 in third-party liability coverage,

- $1,500,000 in uninsured/underinsured motorist coverage, and

- $10,000 in medical payments per person per accident.

Again, the coverage offered by Uber is comparable. However, due to the specific coverage required by New Jersey law, we recommend discussing your claim with a Hoboken Uber and Lyft accident lawyer.

Usually Involves Three Parties

While few accidents involve more than two parties, it’s much more common in rideshare accidents. Even Uber found that over half of all accident fatalities were third parties not using the app to drive or request a ride. If you are a passenger, this means that you’ll be vying for compensation through the rideshare’s policy at the same time as another victim.

However, if you were driving another vehicle that collided with a rideshare vehicle, there is a chance that you may have to file a claim with the driver’s personal insurance provider. This significantly complicates the claims process without the assistance of a Hoboken Lyft accident lawyer.

[cta_block title=”Rideshare accidents come with many legal complexities that can be overwhelming. Our New Jersey Uber accident lawyers are here to help you. Contact us today.” label=”Free Consultation” link=”https://www.njnylawyers.com/contact/”][/cta_block]

Potential Damages in an Uber or Lyft Accident

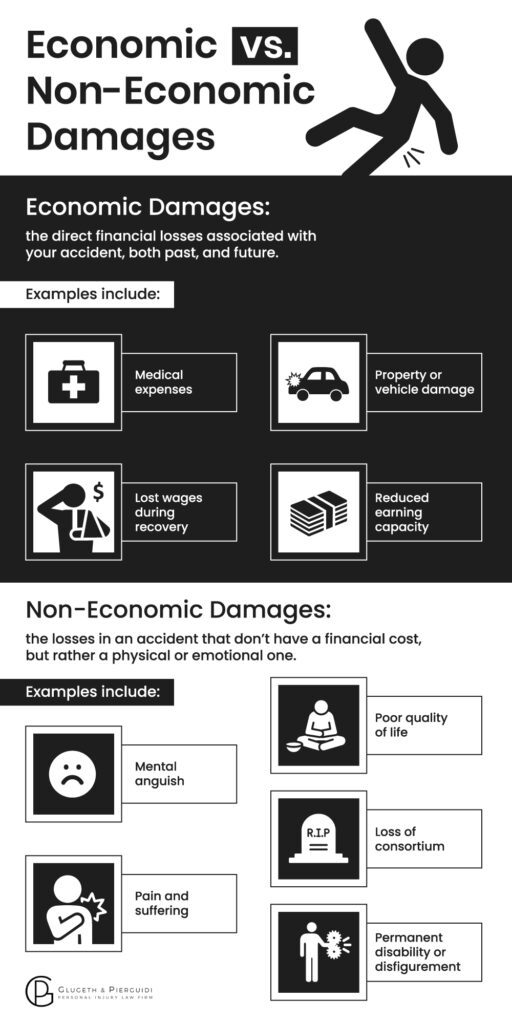

Generally, there are two categories of damages that apply to most rideshare accidents: economic and non-economic. They each play an essential role in your claim’s value, especially if your injuries are severe. Here’s an overview of what they include and how an Uber accident lawyer may calculate them.

Economic

Also known as special damages, economic damages are the financial losses associated with your accident. So what counts as a financial loss? Essentially, it’s any out-of-pocket costs you incur as a result of the accident.

This typically includes things like:

- Hospitalization,

- Medications,

- Surgeries,

- Rehabilitation,

- Prosthetics,

- Vehicle repairs,

- Lost wages, and

- Reduced earning capacity.

A NJ Uber and Lyft accident lawyer may determine the amount of economic damages in a number of ways. Some cases may require consultations with medical experts. This is more likely in claims that involve lifelong disability, since medical expenses may extend into the far future.

Non-Economic

General or non-economic damages are the exact opposite of economic damages. Non-economic damages reimburse victims for intangible losses. In other words, these losses don’t have a price or standard value.

Some of these losses include:

- Mental anguish,

- Pain and suffering

- Bodily Injuries

- Lower quality of life,

- Permanent disability,

- Loss of consortium,

- Severe disfigurement, and

- Pain and suffering.

So what are some examples of non-economic damages? Well, let’s say that before your injury, you had a weekly hobby that involved physical activity, like hiking or swimming. If you suffer an injury that causes a disability, you may not be able to participate in these activities anymore. Or maybe your injury causes chronic pain that limits what you can do and for how long. These losses are incredibly personal, but intangible, making them non-economic.

In New Jersey, similar to other personal injury claims, there’s a strict 2-year timeframe from the accident within which you must file your claim. Failing to meet this deadline could result in the dismissal of your case. The impact of a car accident, often accompanied by shock, might obscure injuries and their signs. Seeking immediate medical attention and reaching out to a New Jersey Uber accident attorney is crucial to prevent the permanent forfeiture of your right to file a claim, ensuring you take timely action after the incident.

Frequently Asked Questions (FAQ)

Due to the complexity of rideshare accidents, many claimants have questions about the claims process. Here are some of the most frequently asked questions regarding rideshare accidents.

It depends. If the driver doesn’t have the app open at the time of the accident, then you may not be able to sue the rideshare. However you can sue the driver and bring a claim directly versus their insurance personal insurance company.

If the driver has their app on when they hit you, you may make a claim with the rideshare company’s insurance. Proving that the driver had their app on may be difficult, so we encourage you to seek the help of a New Jersey Uber and Lyft accident attorney.

Keep in mind your claim for PIP benefits will need to be made through your car insurance company, or resident family member’s policy. It is important to speak with an experienced lawyer at Glugeth & Pierguidi to determine the proper insurance companies to file claims with.

How Does an Uber or Lyft Policy Work If There’s More Than One Victim?

If there is more than one victim in a rideshare accident, they often all make a claim under the same policy. Unfortunately, this gets complicated when it comes to policy limits. For example, if there are two third parties injured after getting hit by an Uber driver, the rideshare’s policy denotes a limit for all bodily injuries related to the accident. If your treatment costs more than the policy limit, you may need to look for other sources of compensation. Another potential source is your own auto insurance policy. Since New Jersey is a no-fault states, you may recover some of your economic damages from your personal injury protection (PIP) coverage.

How do Taxi Services Differ From Ridesharing?

Ridesharing platforms such as Uber treat their drivers as independent contractors rather than employees. These drivers utilize their personal vehicles to transport passengers, which distinguishes them significantly from traditional taxi services. Consequently, the insurance policies and coverage levels for taxis and cab drivers differ from those applicable to ridesharing services and their drivers.

The coverage varies depending on the situation. The available coverage amounts differ based on whether the driver was inactive, in transit, or transporting passengers during the accident. For idle periods, Uber’s commercial liability coverage addresses bodily injury and death for injured individuals (excluding the driver) in case of an accident. In instances where the Uber vehicle carries a passenger or is on its way to a pickup, the rideshare liability insurance provides coverage for all injured parties in numerous scenarios.

In most cases, your personal insurance rates should not increase if you were a rideshare passenger during an accident. Since you were not the driver or directly responsible for the accident, your insurance rates are unlikely to be affected. However, insurance policies and regulations can vary, so it’s always a good idea to check with your insurance provider to get accurate information based on your specific circumstances.

At Glugeth & Pierguidi, P.C., we understand how frightening a rideshare accident can be for passengers, pedestrians, and other drivers.

At our firm, we focus on the needs of our clients and believe they need an advocate that’s with them every step of the way. Unlike other firms, we won’t hand you off to an associate attorney. You deserve to have a partner with decades of experience in trial litigation. That’s why our founding attorneys Jared Glugeth and David Pierguidi work personally with every client.

To schedule a free consultation, please call us at 201-699-5070 or contact us online. We proudly serve clients in Hoboken and throughout New Jersey and New York.